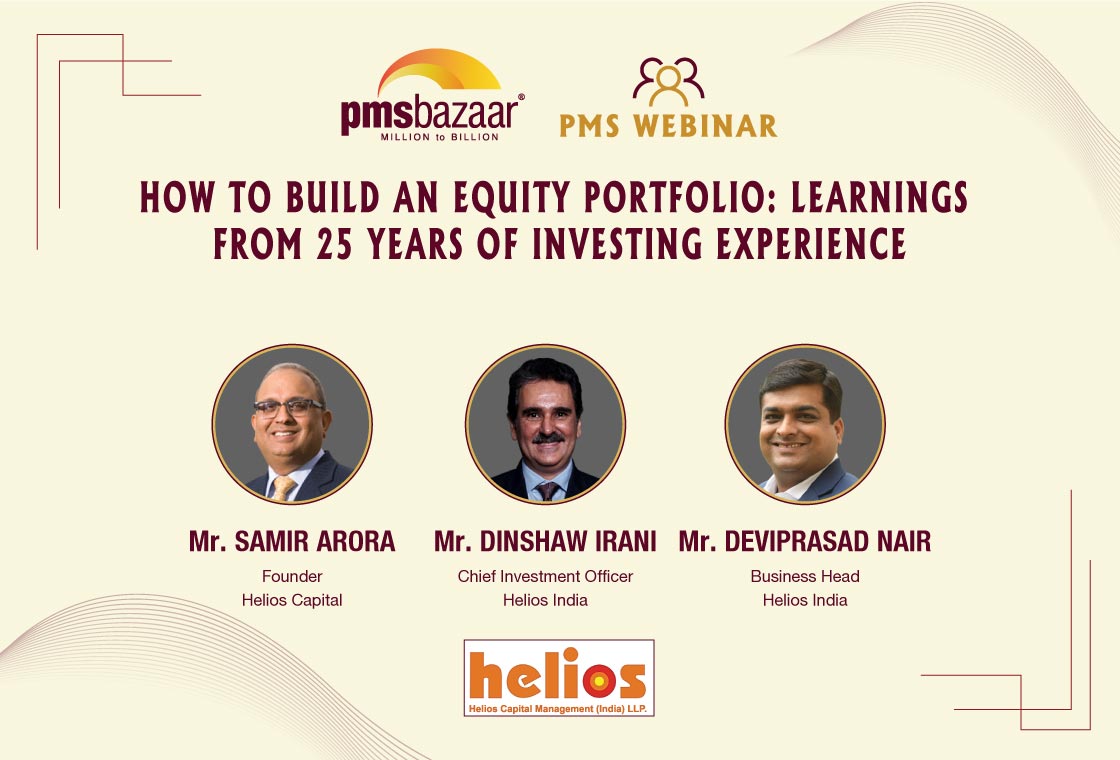

In a special session organized by PMS Bazaar, two experts from Helios namely storied fund manager Samir Arora, and Dinshaw Irani, the CIO of Helios India, shared with investors their lessons and experiences over an hour-long interaction. The investing gurus asked investors to be flexible and challenge the common myths that float around. Samir is a very well-known and respected market voice. He shared his views on some of the assertions any investor would probably hear, and then tried to reveal the reality behind such assertions. Dinshaw explained the investing philosophy behind the Helios India Rising PMS. Read on to know more details.

Two sides

Samir stressed on the need for an investor to be open-minded. "There are two sides to everything," the fund manager said referring to growth investing and value investing.

He appealed to investors to question even the obvious. An assertion is a confident and forceful statement of fact or belief. Talking about some popular assertions, Samir shared with investors how even the so-called obvious truth may have a flipside.

Assertion 1 - 'We should buy stocks where we have

high conviction.'

Talking about this assertion, Samir said conviction is higher in paths we chose not to follow because those decisions were made before we chose the ultimate course. This is true of everything we do in life, every decision we make.

Assertion 2 - 'Our favourite holding period is

forever'

Samir recalled how Warren Buffett often talks about the fact the holding periods needs to be long. But Samir said investors must learn to question the purpose behind long-term holdings if the actual performance is lower than benchmark etc. " (if someone holds a stock forever), it's not enough to say my churn is low if performance is poor," he quipped.

Assertion 3 - 'We own stocks for the long-term.'

Taking the proverbial bull by the born, Samir said that investors must realize that the stocks they bought one year ago may not be the best a year down the line. "One year later prices move up and down, fundamentals move up and down. How can you be sure that the 20 stocks you chose last year are still the best?," Samir asked investors.

Assertion 4 - 'An investor should act as though he

had a lifetime decision card with just twenty punches on it.'

Referring to this assertion, Samir said the proponents often say that investors should therefore be careful about what they are buying. Apparently, the assertion makes one believe that one has to take a long-term view of investing decisions.

But the truth can be confusing. Samir referred to a study by a professor who found that Buffett between 1980 to 2006 had a median holding period of 1 year for stocks and 30 percent of stocks sold within 6 months.

Assertion

5 - 'Buy companies with good management.'

Samir asked investors has anybody ever said that we buy companies with bad management! More importantly, Samir said investors must understand when they will know the good or bad nature of the management. Also, he said investors must be prepared to separate the halo effect."

Show me a company that delivers high performance and I can always find something positive to say about the person in charge," Samir quipped.

Assertion 6 - 'If you are sure of growth, price of

stock will take care of itself.'

On this assertion my market pundits, Samir said one should study IBM and Standard Oil for the period starting 1950 to 2003. IBM was better in terms of growth on revenue per share, dividend per share and earnings per share. But IBM stock underperformed!

Understanding the Field

Samir shared a few insights on the duration of a long term view in choosing stocks.

He said a large number of companies do well over shorter periods. Companies that do well over long periods are obviously fewer in number but are still many in absolute.

The extent of outperformance for many performing companies reduces beyond their 1-3 year sweet spot. So, it is practically and statistically more difficult to find long term winners as compared to 1 to 3 year outperformers due to smaller numbers of such long term winners, Samir said.

Longer term winners normally surprise even themselves, their management and their investors with their growth success, and can therefore not be generally identified well in advance with a high degree of confidence.

So, the sweet spot for an investing horizon is 1 to 3 years for one can visualize industry trends disruption or company strengths etc. more easily over this horizon. "If the company continues to do well, there is absolutely no reason to not hold it for another 1 to 3 years horizon and so on," the celebrated fund manager said.

Referring to the right approach, Samir said investors cannot be rigid in portfolio construction.

According to him, a robust portfolio needs to have 2 kinds of stocks. This is used in Helios PMS.

Stocks that offer high confidence in reasonable returns - Helios aims to have 50% of portfolio in such companies approx 5 percent per name i.e. 10 holdings

Stocks that offer reasonable confidence in high returns - Helios aims to have 50% of portfolio in such companies with 2-2.5 percent per name i.e. 20 to 25 holdings

The Helios way

Dinshaw revealed the investment philosophy of Helios India Rising PMS.

The pillars of their philosophy are

A. Strong theme/size of opportunity - Helios is a bottom-up investor who believes that stock picking works best when aided by the secular tailwind of a strong theme or positive “big picture”. Over decades of investing we have come to strongly believe that while buying robust businesses yields fair returns, adding the benefit of a strong secular tailwind leads to multiyear outperformance, Dinshaw said.

The preferred investment themes are characterized by “Non-zero-sum competition”.

Theme 1: Compete with government owned companies

Theme 2: Demographic/lifestyle changes (primarily urban under-penetration)

Theme 3: Factor Cost Advantage (Information Technology/Pharmaceuticals/Speciality Chemicals etc.)

B. Time horizon - Helios conducted analysis of the past 25 years data and saw that about 1/3rd of the stock performed materially better than the overall market over every period. This is otherwise also logical for if the market average return is an average of all the stock returns (weighted by size of company, no doubt) in general half the companies should do better than average and half should do worse than average.

As indicated by Samir earlier, Dinshaw said Helios believes that the sweet spot for initial investment horizon is 1 to 3 years. But he clarified that long term does not mean Buy & Forget. "We also believe that the long term is a series of short terms. This means that even though we are willing to (and in practice do) hold stocks for long periods, we evaluate them continuously to confirm that our original hypothesis to buy the stock is intact," Dinshaw said.

C. Stocks owned at a time - Since this area was earlier also covered by Samir, we are not going into the details again.

D. When to sell - Dinshaw indicated that although Helios holds most stocks for multi year periods, there is genuine effort put in to continuously evaluate and monitor the companies to confirm whether the original hypothesis on the stock is intact.

He said Helios is not afraid to acknowledge unfavourable developments or departures from our original thesis and may accordingly exit/ trim the position ahead of our originally intended holding horizon. Reasons for trimming/selling stocks may be (absolute or relative) fundamental, stretched valuations or risk control.

If there is deterioration in company fundamentals or an unexpected negative development, stock will normally be sold to zero.

If stock returns significantly outperform underlying earnings growth over an extended period, stock weight may be trimmed or sold completely.

A stock also may be sold/reduced to make room in the portfolio for another stock or for risk control on both stock and sector exposure.

Those who missed the opportunity to hear from the experts directly can listen to the entire session through the link appended below:

For more information, please contact info@pmsbazaar.com

Recent Blogs

Credit Funds in 2025: Trends & Opportunities Fixed Income Investments

PMS Bazaar conducted another episode of the Sundaram Alternate Series -Season 2- Episode 6 “Credit Funds in 2025: Trends & Opportunities Fixed Income Investments”.

Fund Manager’s Proven Strategy for Consistent Returns - Stock Selection Case Studies

PMS Bazaar recently organized a webinar titled “Fund Manager’s Proven Strategy for Consistent Returns - Stock Selection Case Studies” which featured Mr. Arpit Shah, Co-Founder and Member of Investment Team of Care Portfolio Managers Pvt Ltd.(Care PMS). This blog covers the important points shared in this insightful webinar.

Picking Stocks for Long-Term Returns: Leading Fund Manager Sanjaya Satapathy’s Strategies for 2025

PMS Bazaar recently organized a webinar titled “Picking Stocks for Long-Term Returns: Leading Fund Manager Sanjaya Satapathy’s Strategies for 2025” which featured Mr. Sanjaya Satapathy, Portfolio Manager, Ampersand Capital LLP. This blog covers the important points shared in this insightful webinar.

Jan-2025 AIF Performance: Market Pressures Weigh on Returns, Long-Short Funds Outshine

January 2025 was a challenging month for Indian equities, and Category III Alternative Investment Funds (AIFs) reflected broader market headwinds. Several macroeconomic factors—including geopolitical tensions, currency depreciation, and US-led global trade disruptions—contributed to investor uncertainty. Additionally, corporate earnings for Q3FY25 were underwhelming, with the worst earnings downgrade ratio since Q1FY21.

Singularity on India’s New Fund of Funds: Implications for AIFs and Startup Investments

Singularity AMC, a leading provider of capital and differentiated market access for high-growth assets, shares its perspective on the government’s newly announced ₹10,000 crore Fund of Funds (FoF) and its potential to reshape India’s startup investment landscape.

.jpg)

PMS Performance in January 2025: A Challenging Month for Equity Strategies

While January’s numbers were largely in the red, investors should focus on long-term performance and diversification strategies to ride out volatility

AIFs in 2024: Decoding Resilience, Returns, and Art of Alpha Creation

The year 2024 was a pivotal one for India’s alternative investment funds (AIFs), reflecting their enduring appeal to sophisticated investors amidst an evolving economic landscape. Despite facing challenges from a more tempered equity market compared to 2023, AIFs continued to demonstrate their alpha-generation potential. With strategies tailored to navigate market complexities, these funds outperformed traditional benchmarks like the Nifty50 TRI, which posted a modest 10.09% return in 2024.

Resilient Returns: How PMS Strategies Thrived in a Dynamic 2024

PMS schemes shine in 2024 with record-setting performances; strategies navigated volatility, out-performed benchmarks, and strengthened investor confidence across the board